The College of Wooster is committed to providing resources for students’ financial literacy and financial concerns through our Financial Wellness program, MONEY MATTERS. This program provides resources throughout the year to help students tackle complex issues such as banking, budgeting, credit, student loans, and planning for life after college. MONEY MATTERS holds in-person events throughout the year, and can provide tailored programming for student groups and classes.

One-on-one appointments are available to address any financial issues such as financial aid, funding resources, budgeting, credit or any other financial issues. Appointments can be in-person, virtually through Teams or Zoom, or by phone.

Upcoming Events

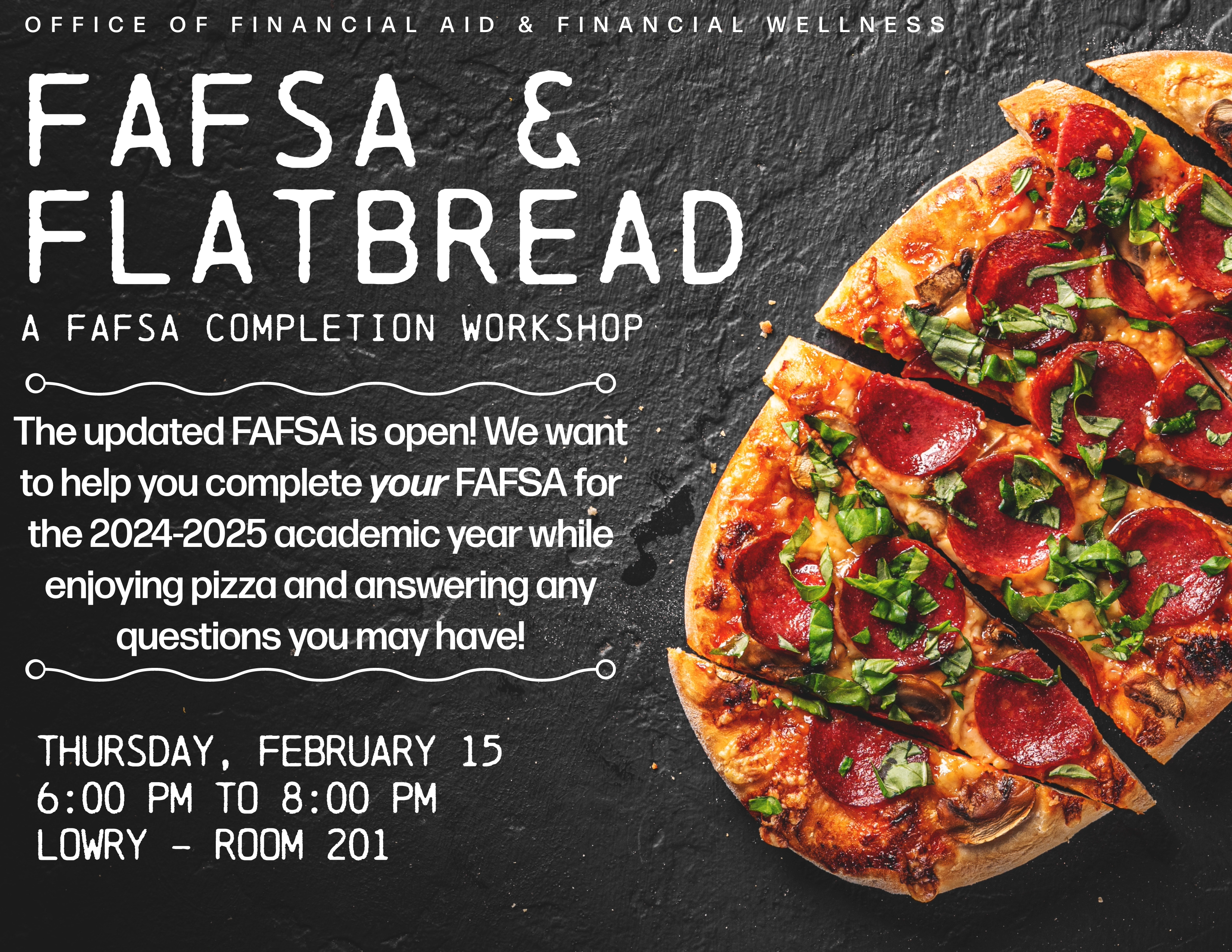

FAFSA Workshop

In this workshop, students will have hands-on help available to complete the FAFSA for the 2024-2025 academic year as the first step in applying for financial aid. You can register to attend at https://wooster.co1.qualtrics.com/jfe/form/SV_dnfYMo38ROoL05o

FAFSA Virtual Completion Sessions

Do you need help completing the FAFSA? Then drop-in during one of our virtual sessions!

Wednesday, February 21, 2024 from 7:30 to 8:30 Join Session

Thursday, March 7, 2024 from 7:30 to 8:30 Join Session

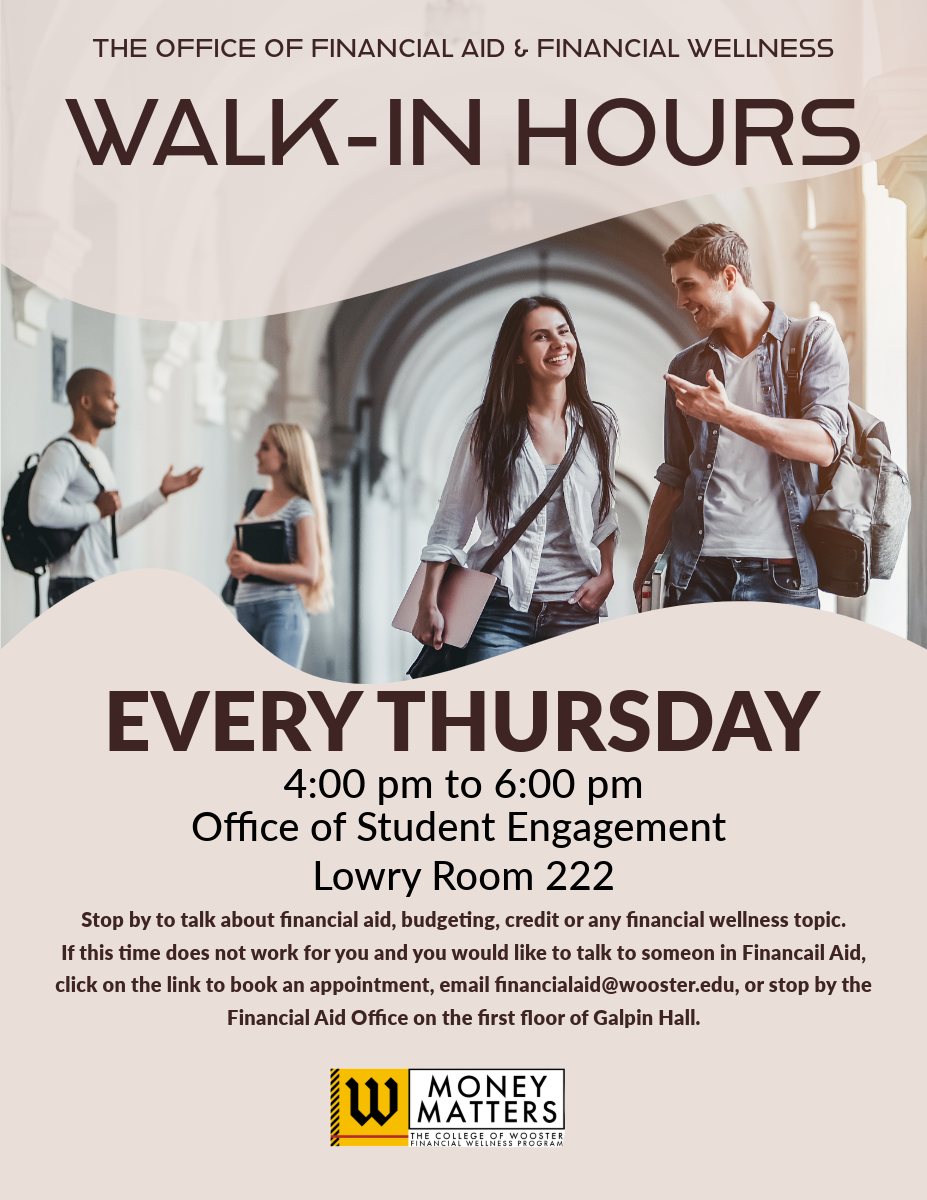

Walk-In Hours Starting February 22!

Stop by to talk about any questions or concerns you may have about financial aid or financial wellness! Can’t make these times, then click on the “Schedule Appointment” link on this page to book a time that works for you, call our office at 330-263-2193, email financialaid@wooster.edu, or stop by our office on the first floor of Galpin Hall!

Why is Financial Literacy so important?

Understanding your finances enables you to make sound decisions both now and in the future. In a college environment there are many complicated, difficult financial decisions that are often being made for the first time. By choosing to stay informed and seek out resources to understand the impact of their financial decisions, students are more likely to succeed and avoid common financial pitfalls. Having strong financial literacy can you make sound borrowing decisions, as well as help you to build credit and achieve financial stability. Watch this video below to learn more about Financial Literacy.