The J.P. Morgan Chase Purchasing Card Program is offered to employees as a more efficient cost-effective method of purchasing and paying for small dollar transactions and as a means of making travel arrangements more convenient to the employee and the College. Its intent is to replace small dollar amount purchase orders, petty cash and personal funds reimbursed to the employee. It also reduces the time between identifying a need and delivery of the need. Under this program, the cardholder has direct contact with the supplier in placing orders based on the transaction dollar limits agreed to by their Supervisor/Department Chair and the Purchasing Card Administrator.

Purchasing credit card holders shall use the Purchasing card in lieu of purchase orders for transactions up to the cardholders authorized limit. Those employees that obtain a Purchasing card are expected to utilize it for allowable purchases if the merchant accepts credit cards and in lieu of requesting reimbursement for purchases made on personal credit cards or other methods of payment.

The Purchasing Card must be used for business purposes only, and all purchases must comply with all The College of Wooster policies and procedures. The card belongs to The College of Wooster. The Cardholder is responsible for assigning the appropriate General Ledger account number for each transaction.

Program Overview

- How to Obtain a Purchasing Card: A Purchasing Card Application can be obtained from the College’s secure web site. The Vice President for Finance and Business and/or the Controller will have final approval authority over all Purchasing Cards decisions and spending limits.

- Purchasing Cardholder Agreement: This agreement indicates that the cardholder understands the intent of the program and agrees to adhere to the established guidelines. The card will be released by the Office of Procurement only after the cardholder has completed the Purchasing Card agreement and training. The cardholder must adhere to College policies and procedures.

- Eligibility and Application: When a valid business purpose is demonstrated, College full- time employees may be eligible for a Purchasing Card issued in their name with supervisor/department chair/Provost or VP level approval.

- Training in Use of Purchasing Card: It is mandatory that each cardholder and their supervisor/department chair attend or participate in a training session. The intent of the training session is to instruct cardholders and their supervisor/department chair in policy and procedures, expectations, code of conduct and review/reconciling procedures.

- General Use: The Purchasing Card is the preferred method for high-volume, low dollar purchases and travel expenses. The Purchasing Card may be used to purchase any item that falls within the guidelines provided by College policies and procedures and this manual. The purchase must be within the cardholder’s assigned dollar limit. There are some purchases that are deemed inappropriate use and there are some exceptions and restrictions to Purchasing Card use. See section on restricted use.

Splitting one purchase into two or more transactions in an effort to avoid single purchase credit limits will be considered a Violation of Agreement (see Section II. A. 4.). - Expiration and Reissue of Cards: The expiration date is determined by the date your card was initially issued. J.P. Morgan Chase automatically sends replacement cards. Your new card should arrive 2-4 weeks prior to its expiration date, which is on the last day of the month embossed on the front of the Card. All new cards are sent to the Primary Purchasing Card Administrator in the Office of Procurement for distribution. Once you receive your new card it needs to be activated and the cardholder must assign a Personal Identification Number (PIN) number to the card at this time. The automated service by Chase will prompt or instruct the Cardholder on how to assign a PIN.

- Changing Information or Canceling a Card: To apply for changes or to cancel your card, please contact the Primary Purchasing Card Administrator via email at tholtz@wooster.edu.

- Forms and Manuals: The Purchasing Card Manual and all forms and information associated with the program are available at College’s Secureweb site.

- Allocation of Charges: Charges are automatically charged to the Default Account Number unless the account number is changed during the on-line approval process. Charges may be allocated to more than one account when approving these Purchasing Card transactions. Currently, charges may be allocated between ten (10) or less accounts by amount or by percentage.

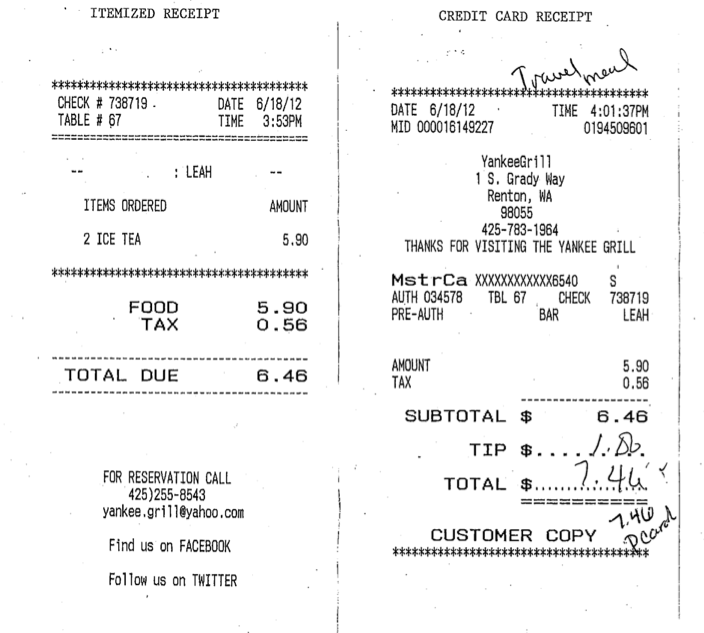

- Documentation Requirements: Cardholders must follow established policies regarding the reimbursement of expenses to employees under the College’s accountable plan. Cardholders must always obtain an itemized receipt for each transaction. The credit card approval slip is not adequate documentation. Receipts must be submitted along with the monthly cardholder statement in the Purchasing Card Envelope. See sample itemized receipt on page 9.

If proper documentation has not been obtained, it is the cardholder’s responsibility to remedy the situation. The cardholder will be required to contact the vendor to request a copy of the itemized receipt. If the purchase is unable to be substantiated, it is the cardholder’s responsibility to reimburse the institution. See Section K below. - Accounting Procedures: Monthly statements will not be mailed. Statements are available for download by the 21st day of each month. The following items are critical for each month:

- Cardholders can access their accounts at: https://smartdata.jpmorgan.com/sdportal/home.view

- Transactions should be reviewed and approved throughout the month. Statements are issued on the 21st day of each month. The on-line approval process can be finalized throughout each month. You do not have to wait for the statement before approving transactions on-line. All transactions must be approved on-line by the last business day of each month.

- Once the statement is printed, all itemized receipts shall be numbered as they appear on the statement, and the receipts, statement, and Pcard approval cover page must be submitted to the Business Office via house mail envelope. This envelope should be submitted no later than the 10th day of the following month. Please provide your name, statement date, your department, cardholder signature and date. Cardholders must follow established policies and procedures.

- If a receipt is missing, the cardholder must complete the Missing Receipt Affidavit found here: https://inside.wooster.edu/business/policies-and-forms/ and include it with the statement and itemized receipts. Warning: Repeated use of the Missing Receipt form as substitute documentation could result in a loss of card privileges.

- All Purchasing Card documents are subject to review by the Business Office and external auditors.

- Failure to report or document any purchase may be deemed improper use of the card.

- Please note that transactions prior to the fiscal year end that are not listed on the June

credit card statement will be posted in the next fiscal year.

Note: Receipt is defined as follows: an invoice, cash register receipt, sales slip, or packing slip which contains an itemized list of goods purchased with dollar amounts and the name and location of supplier. An employee of the supplier must sign handwritten receipts. All receipts shall have the date and time of the transaction.

- Approvals: All cardholder transactions must be reviewed and approved by a higher level of authority within the cardholder’s department. The higher level of authority is established during the application process. Additional approval may be required for grant related expenditures.

- Reviews: Monthly activity reports are generated by J.P. Morgan Chase for each cardholder and are reviewed by the Business Office to determine that transactions follow and adhere to guidelines, intended use, and College policies and procedures.

Cardholder Responsibilities

- Everyday Use

- Rules and Procedures

- Cardholders must abide by College policies and procedures.

- The card is for College business purposes only.

- Itemized receipts must be obtained for all Purchasing Card transactions.

- The Card is not transferable. It may be used by the cardholder only.

- Cardholders may not receive cash back for refunds or exchanges. Amounts must be

credited to the Purchasing Card account. - Cardholders may not receive cash advances on their Purchasing Card account.

- The cardholder is personally liable for any improper use of the card. These costs

include, but are not limited to, the purchase, interest incurred, and any card fees. The cardholder is not responsible for the improper use as the result of a lost or stolen card which was immediately reported.

- Preventing Fraud

The cardholder should use basic security measures to guard against fraud.- Sign your card as soon as it arrives.

- Keep card in a secure location; guard it carefully.

- Save receipts and statements in a secure area because they may contain your card

number. - Keep an eye on the card during the transaction; retrieve it as soon as possible.

- Always know where your card is. If you cannot find your card then assume the worst,

have your card canceled and request a new card. - Be aware of what you are signing. Disreputable merchants can make multiple imprints of a card by placing an extra slip beneath the top legitimate slip allowing your signature to copy through to the other slips. The cardholder unwittingly signs the extra slip.

- Review your monthly statement closely. Make sure all transactions are legitimate.

- Report fraud immediately.

- Do not discard credit card slips in public areas.

- Do not discard credit card slips whole.

- Do not lend your card to anyone.

- Do not give your credit card number to anyone over the phone unless you know it is a reputable vendor.

- Restricted Use

The Purchasing Card should not be used to purchase the following items:- Alcohol for Consumption: The College will pay for the limited purchase of alcoholic beverages to the extent that the amount of purchase is responsible and proportional to the completion of College business according to applicable policies and approval determined by the Provost or VP level.

- Capital Equipment. Capitalized equipment generally must meet criteria of $5,000 or more and a life expectancy of five (5) years or more.

- Maintenance/Service Agreements must follow the guidelines established for purchase orders and contracts.

- Computers, Computer Related Equipment, Software Multimedia, Projection/Digital display, Sound/Audio, copier, printer, scanner, telecommunications, conferencing, video surveillance or capture, network, WiFi, and Maintenance/Service Agreements related to such equipment or software: All must be approved by the Chief Information and Planning Officer before purchase to insure that the purchase adheres to College’s standards for technology equipment, software, and services.

- Personal Items: All purchases must be for the use and benefit of The College of Wooster. Should any personal charges be unintentionally charged, the cardholder will promptly reimburse the College for the amount of the personal charges.

- Cash Advances.

- Meals or snacks: Hospitality expenses are defined as the furnishing of food and beverages to employees and guests with the intent to advance the interests of the College. These are subject to all existing College policies.

- Contract Services. All purchases of services relating to technology applications, including “cloud hosted” applications, consulting, application design/programming, must be approved by the Chief Information and Planning Officer.

- Gift cards, gift certificates, and other gifts, prizes and awards.

- Violations of Agreement

Improper use of the card and failure to comply with accounting procedures and deadlines by the cardholder may lead to suspension of all Purchasing Card privileges and disciplinary action. Card usage may be reviewed at any time.- Misuse or Abuse of the Card

The term “misuse or abuse” means the use of the Purchasing Card outside the employee’s authorized parameters (e.g., charges in excess of the permitted limit, purchases of items of a type other than those allowed, unsubstantiated purchases). Depending on the severity of the violation, the following actions may be taken:

1st offense: Both the cardholder and the supervisor/department chair will be notified of the infraction. The cardholder will be advised to use the card for official purposes only, and within the parameters established by The College of Wooster. The cardholder will be advised that all Purchasing Card privileges will be suspended if further violations occur. The cardholder will be personally responsible for reimbursing the College for unauthorized purchases.

2nd offense: All Purchasing Card privileges will be suspended for a period of three (3) months. The supervisor/department chair, the Vice President for Finance and Business and the Controller will be notified of this violation and subsequent suspension of privileges. At the end of the three (3) month period, the supervisor/department chair may elect to reinstate the cardholder’s privileges, with the approval of the Purchasing Card Administrator. The cardholder will be personally responsible for reimbursing the College for any unauthorized purchases.

3rd offense: Use of the Purchasing Card will be suspended permanently. The cardholder will be personally responsible for reimbursing the College for any unauthorized purchases.

Note: The College may implement further disciplinary action. - Fraudulent Use of the Card

The term “fraudulent use” means the use of the Purchasing Card with a deliberately planned purpose and intent to deceive and gain a wrongful advantage for oneself or anyone else. The following actions will be taken:- Immediate suspension of card privileges.

- Removal of cardholder’s purchasing authority.

- Mandatory employee reimbursement to the College (can include withholding

from payroll). - Formal disciplinary action which may result in termination of employment.

- Possible criminal prosecution.

- Misuse or Abuse of the Card

- Sales Tax

Cardholders should not pay Ohio sales tax. The cardholder must tell suppliers the College is exempt from Ohio sales tax. A copy of the College tax exempt form has been provided with your Purchasing card sleeve. It also can be found on the Business Office Inside Page: https://inside.wooster.edu/business/policies-and-forms/

It is the responsibility of the cardholder to correct charges for Ohio sales tax with the vendor. If the correction has not been made prior to reconciling the statement, the employee must document sales tax with an explanation of their efforts to correct the charges.

Wal-Mart requires that a separate Tax Exempt Identification Card be presented along with the Purchasing Card at the time of purchase in order for the transaction to be exempt from sales tax. These cards can be obtained from the Office of Procurement.

While traveling, the cardholder should inform the vendor of The College of Wooster’s tax exempt status. Check with the Office of Procurement to see if the College has tax exempt status within the state(s) you are traveling. Some states do not recognize this exemption status and tax will appear on the itemized receipt. This is acceptable and will not be held against the cardholder. - Resolving Errors/Problems with Card Use

- Disputed Items: To dispute a transaction the cardholder must contact the customer service number on the back of the credit card. The dispute must be filed as soon as possible, but within 60 days. A copy should be included along with the statement and receipts in the envelope.

- Lost/Stolen/Fraudulent Use of Card: If your card is lost or stolen, or if you detect a fraudulent transaction: Report loss, theft, or fraudulent use of the card immediately:

- Contact J.P. Morgan Chase at 1-800-316-6056.

- Have your card number or Social Security number ready.

- Report the transaction in question. Have the transaction number and basic information ready.

- Inform your supervisor/departmental chair.

- Inform a Purchasing Card Administrator (email addresses and telephone extensions listed on page 8).

- When reconciling the statement, mark the disputed/fraudulent transaction and submit a Statement of Disputed Items Form with your Purchasing Card statement and itemized receipts.

- Damaged Cards: If the card is damaged or demagnetized call J.P. Morgan Chase at 800-316-6056.

- Employee Separation

Upon leaving the College, cardholder must return the Purchasing Card to the Primary Purchasing Card Administrator in the Office of Procurement.

- Rules and Procedures

Supervisor/Departmental Chair Responsibilities

- Card Approval: Determine who should receive cards, have them complete an application

with your signature approval and forward it to a Primary Purchasing Card Administrator. - Oversee Appropriate Use of the Card:

- Review the purchasing transactions on-line to ensure that the Purchasing Card is being used appropriately. Itemized receipts can be obtained from the cardholder and reviewed prior to approving on-line.

- Ensure that all transactions are assigned to the appropriate expense account.

- Make sure that all transactions are reconciled to the Purchasing Card statement by the last business day of each month.

- Ensure that all documentation is forwarded to the Business Office by the 10th day of the following month.

- As soon as possible, notify the Office of Procurement that the cardholder has been transferred to another department, retired, or is no longer a College employee.

Frequently Asked Questions

- How do I contact Customer Service?

The J.P. Morgan Chase’s Customer Service number is 1-800-316-6056. Automated Voice Response Unit (VRU) for account balances, recent transaction activity, and payment information is available 24 hours a day, 7 days a week. - How do I cancel a Purchasing Card?

Employees who leave The College of Wooster will return their cards to the Office of Procurement. The card will be canceled and destroyed. - What if my Purchasing Card is declined?

Have the merchant contact the toll free number on the back of the card (800-316-6056) to determine if the card was truly declined and not a machine malfunction. If the machine malfunctions, J.P. Morgan Chase can walk the merchant through the proper steps to obtain an authorization of the card. If the card was declined the merchant can hand the phone to you and J.P. Morgan Chase will supply the reason to the cardholder. - What if my card is lost or stolen?

Call the J.P. Morgan Chase customer service number 800-316-6056 if inside the United States or 847-488-3748 if outside the US as soon as possible. Available 24 hours a day, 7 days a week. Also report the loss to one of College’s Purchasing Card Administrators and your supervisor/departmental chair. - What if I need my limit increased?

Written authorization for your request may be sent to a Purchasing Card Administrator. Written authorization comes from your supervisor/departmental chair. The Vice President for Finance and Business and/or the Controller reserves the right to determine if limits are appropriate. - My card is expiring next month, how do I get a replacement card?

The expiration date is determined by the date your card was initially issued. J.P. Morgan Chase automatically sends replacement cards. Your new card should arrive 2-4 weeks prior to its expiration date, which is on the last day of the month embossed on the front of the Card. All new cards are sent to the Purchasing Card Administrator in the Office of Purchasing and Contracts for distribution. - How do I reset my password?

Passwords must be changed every 90 days. You will be prompted when you log on the J.P. Morgan Chase web site. Contact the Office of Procurement and Contracts if you need assistance. - What are the key timelines?

20th day of each month: Monthly cycle ends

21th day of each month: Monthly statements available to download

Last business day of each month: All transactions must be reviewed and approved on the J.P. Morgan Chase web site

10th day of each month: All itemized receipts and the monthly statement must be enclosed in the Purchasing Card Envelope and submitted to the Accounts Payable Manager

Contact a Purchasing Card Administrator for additional information.

tholtz@wooster.edu, Primary J.P. Morgan Chase Purchasing Card Administrator or Accounting Associate, Jennifer Kirkpatrick jkirkpatrick@wooster.edu

The itemized receipt and credit card receipt together are acceptable documentation. The credit card receipt by itself is not acceptable as it does not satisfy IRS documentation requirements for expenses.

If you do not have the itemized receipt portion, complete and attach the Missing Receipt Affidavit.