Please take some time to review what’s changing so you can make informed decisions about your benefits each year during Open Enrollment.

Benefits Enrollment Online – Active employees and those on leave

Open enrollment will be accessible Saturday, November 1, to Saturday, November 15, 2025, for active benefits-eligible employees to ENROLL or WAIVE their benefits elections for 2026.

This is an ACTIVE enrollment process, meaning that ALL benefits-eligible employees must actively enroll or decline their benefits elections for 2026. The benefits enrollment includes medical, dental, vision, FSA Healthcare, FSA Dependent Care, and Health Savings Account for 2026. FSA accounts MUST be actively elected each year.

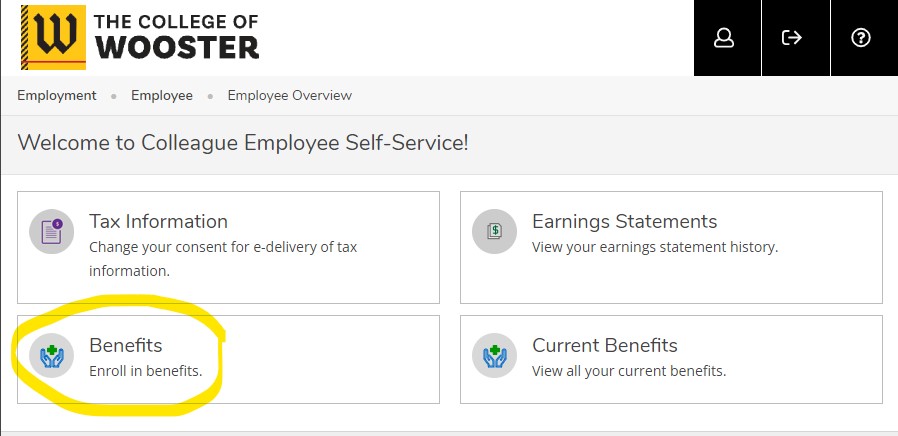

Simply log into Self-Service and select Benefits/Benefit Elections to go through the Benefits Enrollment Online Process.

Looking for additional assistance? Announcing Bring-Your-Own-Device Days:

The Office of Human Resources will have in-person, walk-in assistance hours during Open Enrollment where the HR department will be available to assist with Open Enrollment. Please bring your own device, make sure you have your College username and password, and have your dependent’s information (dates of birth, social security numbers) with you, if you plan to enroll them on your coverage. Sessions will be held in the Office of Human Resources in the Service Center:

- Monday Nov. 3 | 1 – 4 p.m.

- Wednesday Nov. 5 | 9 a.m. – Noon

- Friday Nov. 14 | 11 a.m. – 2 p.m.

Open Enrollment via Self-Service:

Opens: Saturday, November 1st, 2025

Closes: Saturday, November 15th, 2025

1.Click through below to log-in to Self-Service and navigate to Employees > Benefits > Begin Enrollment.

2. Enroll/Waive selections.

3. Review dependent information, if applicable.

4. Review your elections via “Review and Submit.” Save this page for your records.

^^^^If you are at this page, you have NOT finalized your enrollment yet.

5. Check the box under “Terms and Conditions” to sign your enrollment. Click SUBMIT.

6. Save the confirmation page for your records. You have successfully submitted your enrollment for 2025! Congratulations!

7. You may return to self-service and make and edits before Nov. 15. If you change your elections you will have to follow the previous steps and RE-SIGN and RESUBMIT your enrollment.

- LifeTime Term Life Insurance & Long Term Care Access enrollment is processed through CHUBB directly: Enroll here.

- Pet Insurance enrollment is processed through MetLife directly. Find out more information here.

Open Enrollment Assistance, Resources, and Presentations:

Presented by Alera Group, and your Office of Human Resources.

Recording and BrainShark presentation are available below. The presentation recording is the full, live event, and the BrainShark is a go-at-your-own pace version of the presentation.

What’s Changing for 2026:

Healthcare Cost Increase 2026:

2026 Healthcare Cost Calculator (you must login)

Preferred Provider Organization Plan Deductible and Out-of-Pocket Max Increase:

| In-Network | In-Network | Out of Network | Out of Network | |

| 2025 Single / Family (current) | 2026 Single / Family (upcoming) | 2025 Single / Family (current) | 2026 Single / Family (upcoming) | |

| PPO Deductible | $1,000 / $2,000 | $1,500 / $3,000 | $2,000 / $4,000 | $3,000 / $6,000 |

| PPO Out-of-Pocket Max | $2,000 / $4,000 | $3,000 / $6,000 | $4,000 / $8,000 | $6,000 / $12,000 |

High Deductible Healthcare Plan Deductible and Out-of-Pocket Max Increase:

| In-Network | In-Network | Out of Network | Out of Network | |

| 2025 Single / Family (current) | 2026 Single / Family (upcoming) | 2025 Single / Family (current) | 2026 Single / Family (upcoming) | |

| HDHP Deductible | $1,650 / $3,300 | $3,000 / $6,000 | $3,300 / $6,600 | $5,000 / $10,000 |

| HDHP Out-of-Pocket Max | $3,300 / $6,600 | $5,000 / $10,000 | $6,600 / $13,200 | $8,000 / $16,000 |

College of Wooster Dental Premiums will increase for 2026. Premium changes are detailed below:

| (Monthly costs listed) | 2025 | 2026 (upcoming) |

| Employee | $21.41 | $26.72 |

| Employee + 1 | $40.61 | $49.46 |

| Family | $80.98 | $97.30 |

HSA (Health Savings Account) Changes for 2026:

| 2025 | 2026 | Change | |

| HSA Contribution Limit (Employee + Employee) | Self-only: $4,300 Family: $8,550 | Self-Only: $4,400 Family: $8,750 | Self-only: +$100 Family: +$200 |

| HSA Catchup Contributions (Age 55 and Older | $1,000 | $1,000 | No Change |

FSA (Flexible Spending Account) Changes for 2026:

| 2025 | 2026 | Change | |

| Healthcare FSA Contributions | $3,300 | $3,400 | +100 |

| Dependent Care FSA Contributions | $5,000 | $7,500 | +$2,500 |

Telehealth Changes for 2026:

| 2025 | 2026 | Change | |

| PPO Telehealth | $0.00 | $0.00 | None |

| HDHP Telehealth | $59 | $30 | -$29 |

Anthem ID Cards Update:

Starting January 1, 2026, hard copy Anthem ID cards will no longer be distributed. To access your most up-to-date insurance card, please download the Sydney Health app, which provides a secure and convenient digital version. You can also request a hard copy card by visiting anthem.com.