**Self Service Time Entry Help/Training Documents**

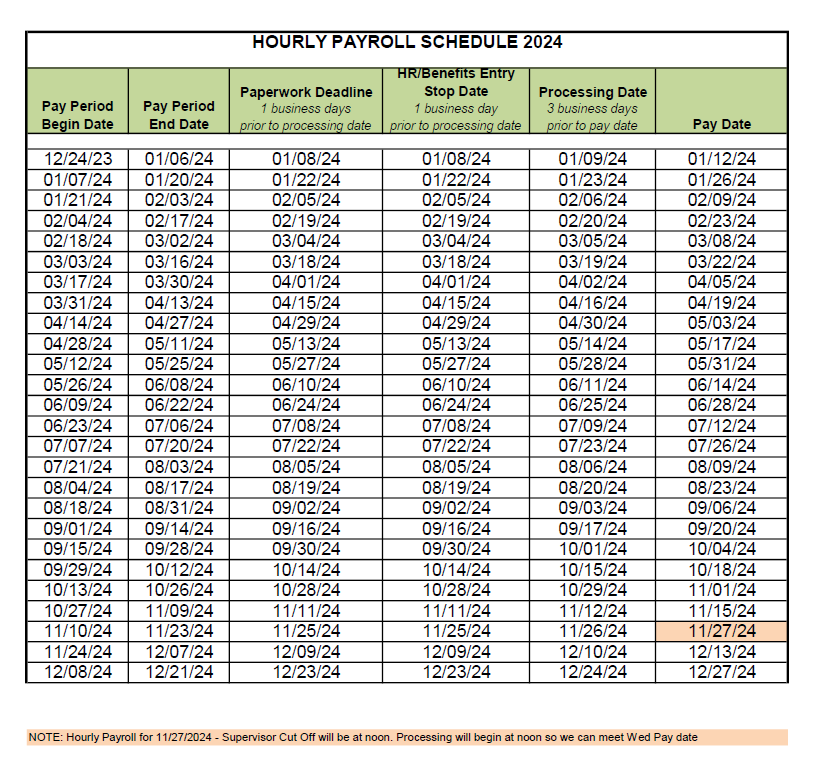

REMINDER: Hourly payroll entry is not available until the Wednesday following the end of the pay period. This is due to payroll processing. Please track your hours until you are able to enter them.

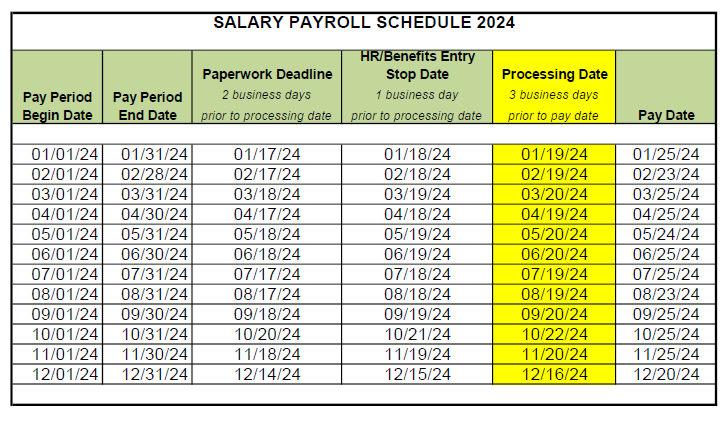

Salaried Employees

Salaried Employees are paid in twelve monthly installments on the 25th of each month (or the last working day before, if the 25th falls on a weekend or holiday) according to the payroll schedule below. The salaried employee payroll begins on the 1st day of the month and ends on the last day of the month.

Hourly Employees

Hourly employees are paid bi-weekly according to the payroll schedule below indicating the date the electronic time sheets are due. The hourly employee payroll work week begins on Sunday at 12:01 a.m. and ends on Saturday at 12:00 midnight.

For payroll related questions, please email payroll@wooster.edu or contact:

Payroll Staff

Carrie Rowland

Manager, Payroll & Accounts Payable

(330) 263-2086

Eileen Walker

Associate VP/Controller

(330) 263-2018

Wish to contribute to The Wooster Fund by payroll deduction? Use this form.

To utilize the most efficient and convenient method of payroll distribution, The College of Wooster requires all full-time and part-time employees to direct-deposit net pay into a checking or savings account. The checking or savings account may be at virtually any U.S. bank, savings & loan association, or credit union. A paper pay stub containing pertinent payroll information about each electronic direct-deposit is supplied to the employee on each payday.

Changing Direct Deposit Option: In the event an employee would like to change their direct deposit account, a completed Direct Deposit Form should be forwarded to Payroll (payroll@wooster.edu) with the appropriate documentation.

Direct Deposit Form for Employees

Wooster Financial Institutions: Many financial institutions in Wooster/Wayne County offer regular or special checking accounts with no monthly service fees to customers with electronically deposited paychecks. To learn more about these options, please contact the financial institutions. Some financial institutions may require minimum deposits and/or enrollment in specific types of accounts to avoid being charged monthly service fees; contact the financial institution for further details.

Eligibility: In accordance with IRS guidelines, the ‘distance test’ and ‘time test’ described below must be satisfied as a result of the employee’s move to be eligible for moving expense reimbursement.

Distance Test: The College of Wooster must be at least 50 miles farther than the employee’s previous workplace from the employee’s former residence. The shortest of the more commonly traveled routes must be used in determining the result of the distance test. For example, if the employee’s previous workplace was located 3 miles from the former residence and the location of employment at the College of Wooster is 60 miles from the former residence, the College is 57 miles further than the previous workplace thus the distance test has been satisfied.

Time Test: The employee must work full time in the general are of the new workplace for at least 39 weeks during the 12 months immediately following the employee’s move.

Taxability: Effective January 1, 2019, the IRS defines all moving expenses to be taxable income to the employee. Examples of taxable moving expenses include, but are not limited to, the following: 1) reasonable expenses of moving household goods and personal effects for one trip, including packing, crating and transporting; 2) traveling (fuel or mileage) to new residence; 3) tolls and parking fees 4) pre-move house-hunting expenses; 5) expenses associated with the selling, buying, or renting of a home; 6) expenses for temporary living quarters; 7) meal expenses incurred while moving.

Documentation: The Taxable Moving Expense Reimbursement Form should be completed and returned to the Payroll Office with receipts for all documented expenses.

Reimbursement: Reimbursements are normally included with the employee’s paycheck following the receipt of all required information and review by the Payroll Manager.

The College’s policy is to prohibit the use of overtime unless approved in advance by the appropriate Vice President. However, to avoid excessive overtime use, the following clarification of the College’s overtime policy has been adopted:

Overtime work by non-exempt hourly staff and student employees is prohibited unless approved in advance by the appropriate Vice President.

Vice Presidents may approve, in advance, up to twenty hours of overtime per week for a non-exempt employee.

Under extreme and/or emergency conditions, a non-exempt employee may be authorized to work more than twenty hours of overtime per week if approved in advance by the Vice President for Finance and Business. Such approval may only be granted when all other options are exhausted.

Due to safety and efficiency concerns, a non-exempt employee cannot be authorized to work more than forty hours of overtime per week.

The College of Wooster has established a sick leave pool to benefit employees of the College who suffer a serious health condition for him/herself and/or a member of the immediate family. This pool is administered by Human Resources in accordance with the rules and the process found in the Handbook for Support and Administrative Staff (page IV.6)

Leave Contribution Form

Sick Leave Request Form

Stipends are a payment option only for faculty or staff whose positions are exempt/salaried.

Stipend Request Form

Questions regarding the substitution of hourly compensation for a stipend may be directed to the Payroll Office at ext. 2100.